You’re great at managing your client’s financial plans. But finding time to generate new leads and sales is a different story.

Well, it makes sense: after all, marketing and lead generation might not be your area of expertise. But if you don’t generate leads as a financial advisor, you could find yourself without enough (or any!) clients.

So, in this article, I’ll show you exactly how you can generate pre-qualified leads for your financial advisory business.

Defining what makes a good lead for your financial business

You might be tempted to say “anyone who needs financial services” but that’s too vague!

Targeting a specific client is what makes your marketing 10x easier and more effective.

So, before getting started with lead generation for financial advisers, lay the strongest foundations.

Get clear on:

- Who exactly do you want to work with? – Is it entrepreneurs who want to grow their wealth, young families who want to protect their future, couples whose children have flown the nest and now they’re dreaming of early retirement and holidays? It helps if you have a clearly defined audience who you help. The more specific you can get, the better!

- What are they struggling with? – Your answer should go beyond “making more money” (and that’s why you really need to know your audience).

It could be worrying about how to grow wealth for retirement, how to leave enough money for their children, protect themselves in case the worst should happen, how to retire early, how to make the most out of their money right now, get out of debt etc.

Now, of course, you could help with all of these problems and more, but what’s the two or three most pressing reasons someone gets in touch with you?

- How can you help them? – How exactly do you solve their problem? How do your services help untangle the mess or stress your client’s are in? Do you communicate how you solve this problem directly?

- What are their hesitations? – For example, even though they are interested in investing, they might be scared of losing money or might not feel like it’s urgent enough right now. What is holding them back from working with you?

Traditional methods to generate leads as financial advisers

Once you have a clear understanding of this, you can start to generate leads and sales. You do this by getting in front of your ideal customer, speaking about their problems and telling them how you solve those problems.

Simple right?

Well, yes…and no. You’ve probably been told to do one (or more) of the following things in your business yourself. Maybe you’ve already tried!

But here’s some common advice about lead generation for financial advisors that we think you should take with a pinch of salt!

Getting leads from referrals

Referrals can take a while to kick in and they can be extremely unpredictable. You might get referred the wrong clients who are the wrong fit for your financial advice services or have to wait around for someone to recommend you. Of course, referrals are lovely but you shouldn’t rely on them alone.

Networking in your local area

This can certainly help you get a few clients, but networking groups are very hit-and-miss. They can absorb a lot of your time. If you’re going to go to networking events, it’s best to find ones packed full of your ideal clients. A better strategy would be to find events aimed at your target audience, for example, if you help entrepreneurs you could attend (or speak at!) events for entrepreneurs.

Advertising in local newspapers or venues

They have a limited audience and a short shelf life. You’re basically putting something out and hoping that (out of all the random people who see it) someone is interested in financial advice services. Plus, if you offer them online, too, why limit yourself to local audiences?

Cold calling

This requires A LOT of time and energy, and 63% of people find these calls annoying. So, you could easily put off your prospects or damage your reputation by relying on cold emailing – especially if you’re going straight to the hard sell.

Paid advertising online

Google and Facebook ads are certainly a much quicker method than the previous ones! However, what you get in speed you pay for in…well, money! Ads aren’t necessarily bad. If you put £1 into ads and get £2 back, then that’s great. The problem is, businesses often lose money on ads and don’t see a great ROI.

Instead of the above, there are arguably better ways to get in front of your audience.

How to master inbound lead generation for financial advisers

There are plenty of people who are actively looking for the financial advice services you offer.

So, let’s help them find you!

1. Quiz marketing for financial advisers

Never thought about creating a quiz?

Quizzes for financial advisors go together like fish and chips. They’re actually some of the BEST lead magnets (a resource you offer for free in exchange for your prospects’ email addresses). Your prospects will be eager to fill in your quiz – as LONG as they get something good in return (more on that shortly).

Here’s how to make a quiz that keeps bringing you leads.

Quiz topic ideas to generate leads for financial advisers

The sweet spot is to create a quiz that…

- is related to your industry and services

- brings value to your target clients

- tells you who’s a good lead

A simple but effective way to do this? Start with the questions your audience is googling (yes, just like you’ll do for your blog). For example: “How much do I need to save to retire?”, “How do I get started with investments?” or “How much can I save each month?”.

Then, choose a quiz style and name that matches your focus. Some popular ones are:

- Scorecard – To show them both their strengths and weaknesses (e.g. “The Early Retirement Scorecard”). This is where quiz participants get a score on how well they are performing. So you could quiz someone’s likelihood of retiring by 55 by asking them questions. At the end, they’ll receive a report giving them an indication how well they’re doing and what they can do to improve – super helpful for them.

- Report – To analyse their current performance and strategies (e.g. “Your Pension Saving Report”). This is very similar to a scorecard but simply reframed as a report on how someone is currently doing. It’s a diagnostic tool and can also be helpful to your audience.

- Calculator – To focus on a specific amount of money or time (e.g. “How much money can you actually invest?” or “Your Pension Calculator”)

- Self-assessment – To help them evaluate their current knowledge, preferences and goals (e.g. “The Newbie Investor Self-Assessment”)

- Readiness test – To show them whether or not it’s time to invest in a financial adviser. And if it’s not? To tell them what they need to work on first (e.g. “The Investor Readiness test”)

Such a targeted and helpful quiz will really help you stand out in a competitive market. After all, personalisation alone leads to a 20% increase in sales!

So, by being more personal and helpful with your quiz marketing, you’ll master lead generation for financial advisers and cut through the noise.

Pre-qualifying quiz questions

Financial Advisor Quiz Examples

Below, I’ve included some examples of the best quiz templates we offer using the ScoreApp software.

This Tax Saving quiz takes less than 2 minutes to complete

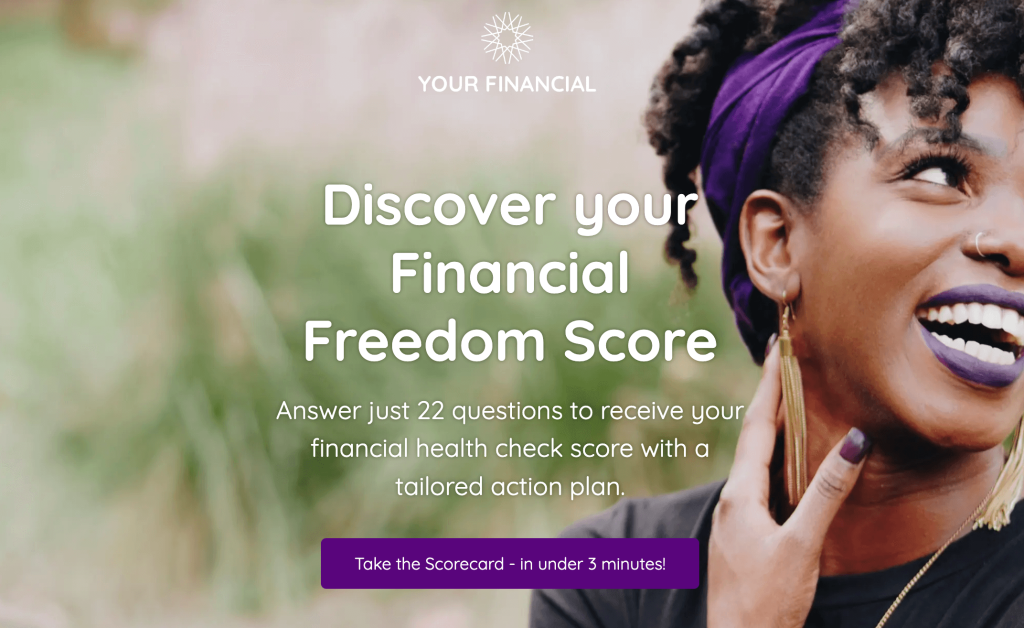

Discover your financial freedom score

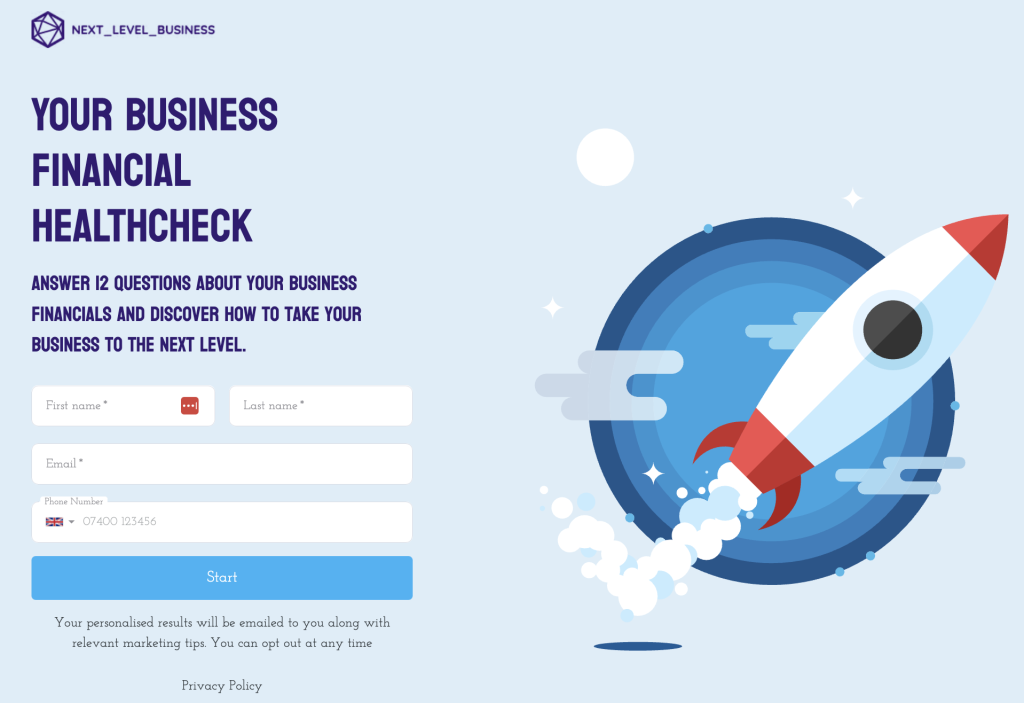

Get your financial health check by answering a few quick questions

To keep your audience engaged, most of your quizzes should be helpful and valuable.

Still, you can – and should – include a few pre-qualifying questions (around 10%). These will show you if a lead is ready for a sales call. For example:

- “How much are you currently saving every month?”

- “Have you worked with a financial adviser before?”

- “Would you like to hear more about how you can start investing with your current budget?”

and so on.

Following up with leads who’ve taken your quiz

By the end of the quiz, your audience will receive a handy report with insightful results, and you will see their answers.

With professional quiz software like ScoreApp, you can then create automated email sequences for each type of result. That way, you’ll nurture your leads until they’re ready to buy from you.

As for those who already are ready, reach out to them! When you offer them a sales call, make it personal by referencing their quiz results:

“Hey Laura,

I noticed you recently took my New Investor Self-Assessment quiz and scored 39%. You scored really high in the SAVINGS section, which is great, but quite low in the FUNDS category.

Would you be up for a quick call with me so I can tell you how we can help you combat this problem?

It’s more effective than random cold outreach, right?

2. SEO blog content

I’m going to take a wild guess and assume you have a business website, right?

That’s a great start. Now, to attract your dream clients, you need to blog on it (and no, your industry isn’t too boring for it).

- Your audience is trying to understand your niche – Most people don’t wake up one day and hire a financial adviser. They first need to understand what’s causing their problems, what options they have, what a financial adviser actually does and so on. So, they’ll google it!

They’ll look for things like how do I retire early? How do I know how much my pension is worth? Should I invest my money in a buy-to-let property etc. These are questions you can answer on your website, and if you have a niche like entrepreneurs, that makes it a little easier as there’s less competition! - Answer these questions for them – Every single blog post can answer a question your audience has. Of course, to know what these questions are, you need to understand your audience. Then, write each article with your specific target client in mind, give value and share your unique perspective

- Optimise your blog posts for SEO – To help your audience find you, use the keywords they are searching. Google Keyword Planner is a handy and free starting point for beginners.

Over time, you can create content for all kinds of prospects, including those who are still trying to understand what you do. For example, “What is a financial adviser?”

But to generate more leads fast? Focus on blog posts for people who already know they should hire one (e.g. “How to choose the right financial adviser for you”).

3. Video marketing for financial advisers

This is another excellent way to answer your audience’s questions, stand out online and generate leads as a financial adviser!

Why, because video marketing is…

- Effective – 84% of consumers are “sold” thanks to video content. Short-form videos (videos under 60 seconds), in particular, will keep on growing, and they’re perfect to keep people engaged (without overwhelming them)

- Personal – Videos allow you to showcase your personality and your own take on a specific topic. This is what will set you apart from everyone else (even when they cover the same subject) and make people want to hire you

Some platforms are better suited than others for short videos, like TikTok, Instagram (Reels), and YouTube (Shorts).

But you can easily repurpose them on other channels (like LinkedIn) or even your website, blog posts and emails.

4. Social media marketing

When you create content and engage with your target clients? You’ll reach new people and make them want to get in touch with you.

You don’t need to stretch yourself too thin by being on every single platform! Start with one or two: the ones where your audience hangs out the most.

This will depend on your target market, but to give you an idea:

- LinkedIn – for business owners and people looking for professional services

- TikTok – to reach Gen Z

- Twitter/X – for an audience who’s already interested in fintech (plus, it looks like this platform is actively moving towards financial services)

- Instagram – to target Gen Z and millennials with a mixture of content formats

- Facebook – to reach different demographics and especially +40s (who are less likely to be on TikTok and Instagram)

- YouTube – to double down on video content

Now, does this mean you must create brand-new blogs AND videos AND social media posts? Not at all!

You can repurpose your content across different platforms. Easy.

Don’t discount those platforms that aren’t very serious like Instagram, because those can be a great place for you to stand out.

5. Be interviewed as a podcast guest

This tactic for lead generation for financial advisers is so good that it almost feels like cheating (but it’s not).

Hoping to get in front of people who don’t know about you and your services yet? Harness other people’s existing audiences!

- Be strategic – Choose relevant podcasts that your target clients listen to

- Fire your best pitch – Contact the host with a topic idea that’d be useful to their audience (while also positioning you as an authority in the financial services industry)

- Use your lead magnet as a call to action – Rather than a boring “Make sure you follow me on social media,” get actual leads by inviting them to take your quiz

Ready to start getting hot leads as a financial adviser?

Instead of wasting time on outdated tactics (or waiting for referrals that may or may not arrive), take charge of your lead generation today.

A strategic quiz, in particular, will complement all your other strategies, too. You’ll get to use it as a call to action:

- At the end of your blog posts

- In your video content

- On your social media

- On podcasts

And the best thing? You can get your entire quiz ready for FREE and in less than 3 minutes thanks to our ScoreApp trial and AI quiz builder. Lead generation for financial advisers has never been easier!